The UK economy is currently navigating a period of flatlining growth, a challenging environment further compounded for businesses by recent National Insurance tax rises.

In response to these financial pressures, many companies are making difficult decisions, including a noticeable trend of “sweating assets” – prolonging the operational life of existing equipment, such as compressed air compressors, for an extra year or two beyond their typical replacement cycle. While this strategy might offer a positive short-term financial impact by deferring significant capital expenditure, it carries substantial hidden costs, particularly if proactive maintenance is neglected.

The Short-Term Gain, Long-Term Pain of Deferred Investment

For businesses grappling with tightened budgets and increased operating costs, delaying investment in new compressed air systems can seem like a sensible immediate solution. By holding onto older compressors, companies avoid the upfront cost of purchasing and installing new, more efficient units. This deferral of capital outlay provides immediate relief to cashflow, allowing businesses to navigate the current economic headwinds.

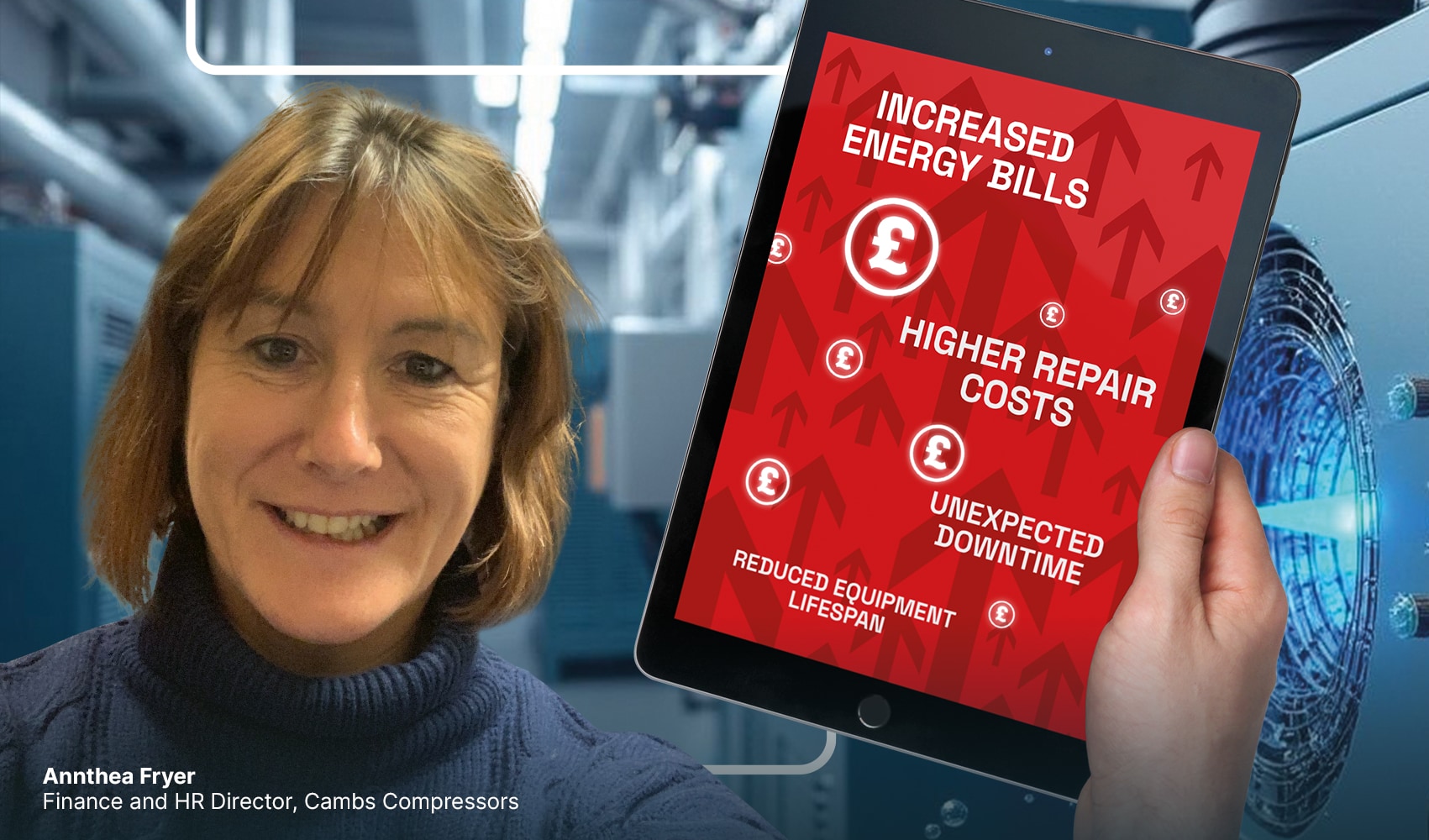

However, this short-term gain often masks a looming long-term pain. Older compressors are inherently less energy-efficient than modern counterparts. As they age, their efficiency can further degrade, and they become more prone to leaks and mechanical issues. Without a robust and proactive maintenance regime, these older systems will inevitably consume more energy, leading to higher electricity bills – a significant hidden cost that erodes any initial savings. Furthermore, the risk of unexpected breakdowns increases dramatically, leading to costly downtime, production losses, and emergency repair expenses that far outweigh the benefits of deferred investment.

A Discrepancy: Market Predictions vs. Real-World Experience

Interestingly, despite the current economic climate, research into the compressed air sector generally predicts growth. Market reports for the UK compressed air market, for instance, project a steady Compound Annual Growth Rate (CAGR) over the coming years, driven by factors such as industrial automation, the demand for energy-efficient solutions, and expansion in key manufacturing sectors. These forecasts paint a picture of an expanding market, with businesses investing in new, advanced compressor technologies.

Yet, the on-the-ground experience across the sector often tells a different story. Many compressed air service providers are observing a clear trend: while the long-term outlook for the market may be positive, individual companies are indeed prolonging decisions on upgrades and replacing their older compressors. This creates a dichotomy between the macro-economic predictions of market growth and the micro-level reality of businesses delaying essential equipment renewal. This delay is a direct consequence of the economic pressures, as companies prioritise immediate financial stability over long-term operational efficiency and risk mitigation.

The Critical Role of Proactive Maintenance

In this environment of “sweating assets,” the importance of proactive maintenance becomes paramount. For businesses choosing to extend the life of their existing compressors, a comprehensive service contract is no longer just an option but a critical safeguard. Without regular inspections, leak detection, and preventative care, the hidden costs of increased energy consumption, frequent breakdowns, and emergency repairs will quickly negate any short-term savings from deferred investment. Proactive maintenance can help bridge the gap, mitigating some of the risks associated with delaying upgrades and ensuring that older systems operate as efficiently and reliably as possible under challenging circumstances.